Two global giants, Walmart and Apple, shook the banking world when they announced the launch of their own embedded financial services offerings. Walmart announced in September 2022 that it would introduce Walmart One bank accounts, first to employees and then eventually to customers of its 5,200 locations. That rollout is just beginning. Apple announced it will soon offer a high-yield Apple Savings account tied to its Apple Card. And rumors have long circulated that Amazon is spinning up a bank.

The sheer size of these household names now jumping into banking with their massive customer base is one worry for traditional banks and credit unions. Another is a little less obvious - these retailers know how to maximize the value of their customer information, something that’s been difficult for financial institutions to master. These retailers know a lot about their consumers (as financial institutions believe they do), but they are particularly skilled at using that information to build engaging customer journeys.

Our recent 2022 Financial Services CXM Impact Report surveyed business banking customers and learned 3 of 4 have walked away from onboarding a new banking product because it was too complicated or confusing. Of those who said onboarding was “not easy” a quarter said they would be unlikely to use their financial institution again for a new product if offered. As retailers deliver smooth, inviting banking journeys, traditional institutions need to figure out how to do the same with their tech stack limitations.

What Makes the Banking Customer Experience Difficult?

Financial institutions have a hard time today deriving value from their rich customer information. Data silos and inflexibility in their platform systems are top complaints among banking executives, and as disruptors move into banking, this hand-cuffed approach to customer information is becoming a danger to profitability.

It’s not a bank or credit union’s fault. The Frankenstein effect is the problem.

Financial institutions are tied into legacy cores. These workhorses are vital to their day to day but not nimble at all, so the easiest way to add functionality without risking downtime, customer impacts or long IT cycles has been to integrate micro-services from the outside into their banking ecosystem. It's a smart move. They can fast-track new offers and gain versatility, quick functionality and cost benefits over trying to build these features in-house. These best-in-breed services are bolted onto existing legacy systems in integration projects, but at the end, they still don’t share information between themselves without manual exports, spreadsheets or other user-created tools.

Composable architecture complicates customer journeys

This hyper-focused composable architecture promotes silos, with information locked in individual platforms. Often, one department doesn’t even know valuable information exists in another. What banks and credit unions end up with is a monster-like infrastructure of disjointed technologies that splinter the view of the customer into little pieces. Their financial needs remain unclear and unattended to. This, historically, has led to higher attrition, less revenue, unappreciated clients, and frankly, missed opportunities to grow the relationship and gain share of wallet.

How Can Financial Institutions Overcome Poor Customer Experience With a Unified Customer Record?

Let's start with what they can't do...financial institutions have tried to cobble together solutions to collate customer information into one place with existing platforms like CRMs. It requires custom code, long timelines, and massive budgets. And even then, if financial providers can afford to wait a year or two to address a lackluster customer view (hint - they can’t if they want to hold onto customers and hold off the Walmarts, Apples and Amazons of the world and others), the solutions are hard-coded, so changes or additions take a long time. Business line leaders need agility and insights, but don’t have the systems to provide them.

The urgency to gain a full view of customer interactions - wherever they happen, outside the organization or across departments - has never been more profound than today. And as financials continue to build fintech partnerships to meet customer demands for friction-less experiences, they will have to grow their ecosystems further complicating this unified view they so desperately need.

How do financial institutions compete with disruptors that can leverage detailed customer information to deliver innovative and convenient banking experiences?

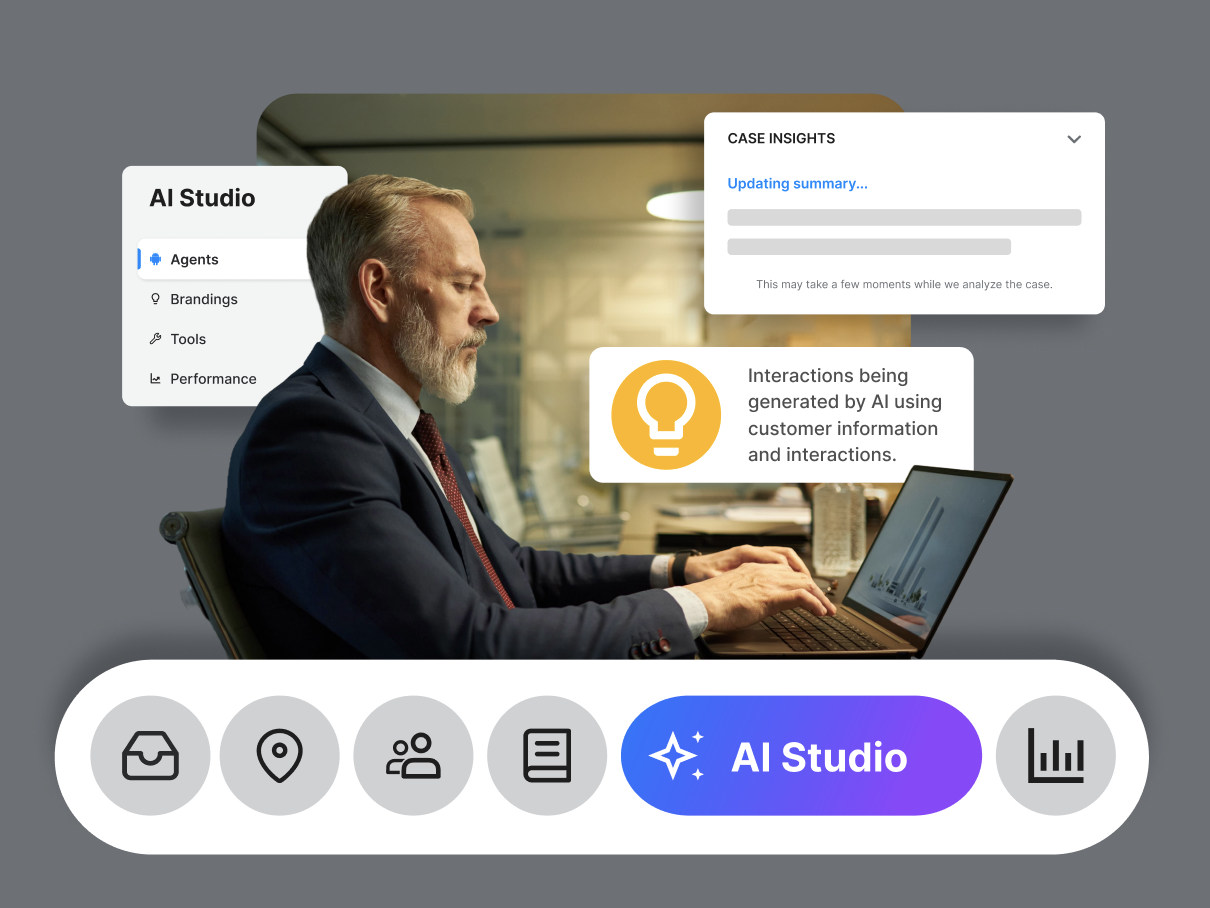

Unifying customer information with CXM empowers banks

Just as CRMs arose in the early 2000s to capture information on prospects and customers during the sales process, CXM has now emerged in response to this need for connected ecosystems and white-glove customer experience. CXM doesn’t replace existing platforms - it was designed to solve for broken journeys caused by disparate systems and stakeholders that deliver disconnected customer experiences. It is an extender of existing systems, helping organizations pull more value from them by unlocking the information they hold and making it visible and actionable to everyone involved in the customer journey.

CXMs utilize information from these different platforms using powerful connectors to open up the flow of information back and forth so financials have a singular, shared view of the customer and are able to see clients at every step in a journey and optimize their customer experience on the fly, in real-time. Partners and organizations alike benefit from this unified view because teams have the full story and can work more effectively on their own and together to deliver on their brand promises.

CXM Technology Helps Banks Do More With Less

The best CXM platforms can’t rely on post-interaction information to drive change any longer. Customers are not that patient; they want smooth curated experiences, and retailers are already providing them.

Platforms like CXMEngine that can draw in customer interactions from every platform - inside and outside the organization - provide a central place where case information, journey progress, omni-channel conversations and on-demand knowledge all live and work together to help internal and external teams provide a more relevant journey to clients. This leads to profound real-world outcomes that deliver rapid ROI and time to value, even in times of economic challenge.

CXMEngine clients have reported incredible results:

- 10% revenue growth

- 20% increase in product penetration

- 60% increase in NPS scores

- 25% decrease in operating expenses

As retailers move into embedded finance more often as a way to keep their customers close, traditional financial institutions must keep pace by maximizing the value of their own rich information to streamline journeys and retain and grow their share of wallet.

The only way a financial institution can do this is by adopting platforms that connect them to their ecosystem partners and distributed teams and technologies so it's all in one central location. Learn more about how CXMEngine complements legacy tech stacks, enabling financial institutions to do more with what they already have and gain a full 360-view of customer interactions inside the organization and with third-parties.

Read the KeyBank case study on how the bank has used CXMEngine to transform how it services customers, driving greater revenue and lower operating expenses.

.svg)