When businesses were asked about their top frustration when onboarding a new financial product or service, 61% chose a response related to a break-down in knowledge or communication.

The survey results are summarized in our 2022 Financial Services CXM Impact Report.

Survey Highlights

We surveyed 4,000+ business owners and operators and asked them about their banking experience while onboarding a new product or service as well as the servicing beyond.

- 6 out of 10 businesses said their onboarding experience was “somewhat” to “extremely” difficult.

- Only 3% said they’ve never had a frustrating experience with their financial institution.

- Enterprises and sole proprietors are more likely than other business segments to give up and move on if they can’t get a new financial product up and running in 48 hours or less.

- 1 in 4 businesses said a difficult onboarding experience would keep them from trying another financial produce/service from their institution.

What do these statistics suggest? They confirm what we see with clients during customer journey mapping sessions, in which we work together to plot touch points in a customer’s journey to identify friction or missed opportunities.

Six Obstacles To Resolving Customer Onboarding Problems

.png)

The top frustrations from business banking clients, across the board, focused on too many people and organizations involved in their journey as well as confusing or missing instructions or direction on what to do. Here are the most common obstacles we see, confirmed by the Financial Services Impact Report findings:

- The support team is missing customer information in their system. It’s likely siloed in other internal systems, but not visible to them. To solve the knowledge gap, they have to call another team or research where to find the information.

- The problem is owned by a partner, like the core provider or processor. Surfacing it takes back-and-forth calls and emails to partners, and that takes time. It also leaves the financial institution at the mercy of the third-party partner (also busy!) to respond quickly. The financial institution is responsible for the customer relationship, but it doesn’t control the CX from end to end.

- The onboarding instructions and process are confusing, so customers have unknowingly missed next steps. Or they are stuck on a milestone and can’t locate and self-serve needed help.

- Hand-offs have been dropped or stalled for some reason. The institution may not even realize the customer is in limbo between teams! If that is discovered, the process has to be restarted.

- Internal teams are unclear about who owns what during an onboarding process. Without clear hand-offs visible across teams and systems, it’s easy to lose sight of a customer.

- The account team lacks knowledge about their customer’s financial product/service so even when they want to help they can’t.

McKinsey, Bain & Company and other analysts agree that customer centricity should be the driver of digital transformation strategy, but the banking industry is hamstrung by legacy systems that were not built to put a customer at the center without massive overhauls or workarounds.

“Automation and technology present the biggest onboarding challenges for banks. Many banks simply do not have the technology infrastructure to make onboarding the seamless, transparent digital experience it needs to be.” McKinsey

Furthermore, the expansion of embedded finance, which gives consumers access to financial services in non-banking platforms, is leading to more partnerships and siloed systems that don’t connect, further complicating the ability for a financial institution to easily follow and monitor journey progress from end-to-end.

Bain & Company estimates embedded finance will account for 10% of all banking transactions by 2026.

CX Management Is Empowering Cohesive Customer Journeys

Customer Experience Management (CXM) technology is exploding, however, as the answer to disparate legacy systems that just can’t innovate fast enough. As companies recognize the urgency of having real-time information on their customer’s experience across teams and ecosystem partners, (before they abandon onboarding and churn) they want solutions that can be implemented quickly, with a minor IT lift.

Read the complete 2022 Financial Services CXM Impact Report from OvationCXM.

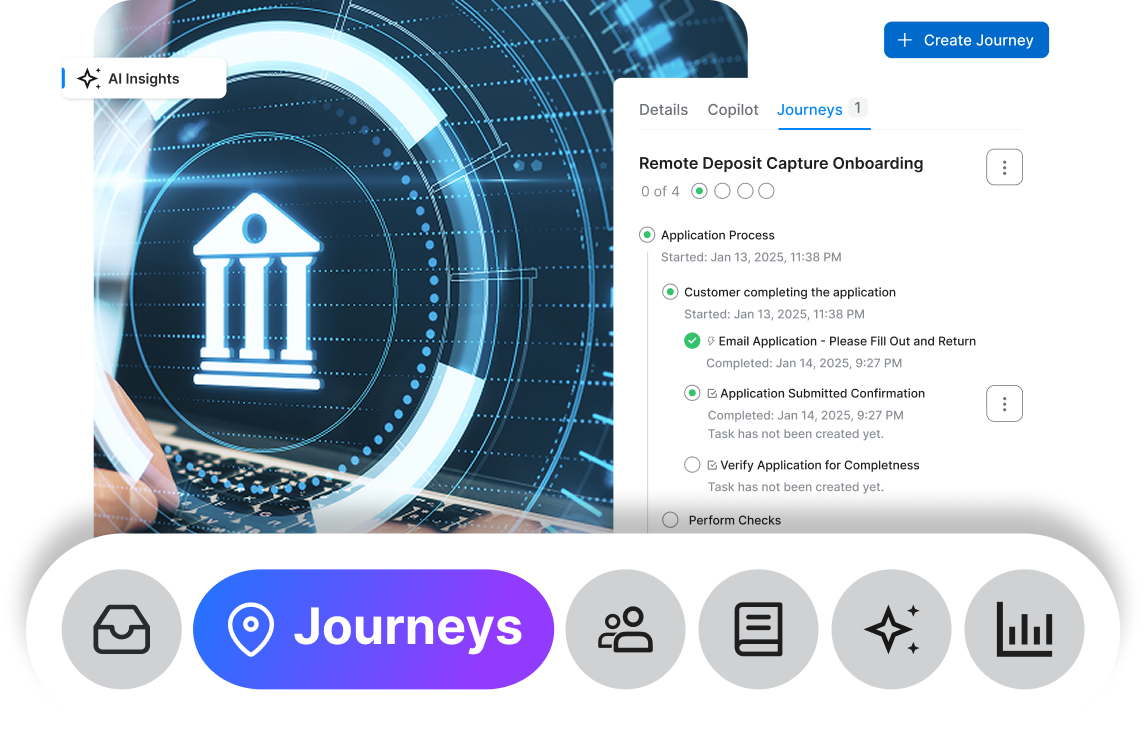

CXMEngine is the first CXM platform to aggregate a customer’s journey information, from cases to tasks to touch points to omni-channel communication and even AI-powered knowledge suggestions in a single screen. Forget toggling between a handful of systems or sending emails or making calls to track down updates or missing information.

CXMEngine plugs into legacy systems as well as some of the world’s biggest CRM and case management platforms, pulling the information together into a unified view, where customer journey interactions are contained in one place. CXM doesn’t replace existing IT architecture or re-engineer it… it makes it better.

This holistic customer view empowers organizations to better deliver on every type of journey, from sales to onboarding and activation to ongoing support and servicing by eliminating knowledge gaps and communication breakdown and by helping prevent customers from being bounced back and forth between teams and partners.

Read the complete 2022 Financial Services CXM Impact Report from OvationCXM.

.svg)