Clients demand reliability

Last week’s article highlighted how an organization can benefit from the network effects already established by other entities through making their products and services complementary and interoperable to their own. We noted that it may be a more daunting task for those organizations with legacy infrastructure (i.e., banks and other financial institutions) to achieve this - they’ll need to incorporate platforms that can pull data from their infrastructure, making it actionable and not siloed. It’s worthwhile to do, though, because more clients will want to do business with a bank that is highly integrated with convenient, fast, and uncomplicated technologies (particularly when it comes to payments).

For instance, let’s examine payment processors. The biggest ones are Fiserv, Global, and FirstData. Business clients (retailers, restaurants, etc.) will want to do business with banks that have established relationships with these companies because they know that they will provide reliable credit card processing. In doing so, those businesses are looking to tap into already established payment processing networks through the equipment sold to them by their bank. They are looking for reliability, ease of use, and a way to constantly be taking in revenue.

Benefits for the Bank

Banks stand to benefit from integrating their technology infrastructure with payment processors by taking advantage of the massive network of transactions that are taking place. Theoretically, a bank should be able to learn from prior instances of set ups and activations. They should be able to tap into knowledge of how a customer’s activation journey should work with that processor. They should be able to utilize the plethora of knowledge that has already been established by the thousands of clients that have utilized that processor.

Presently, many banks don’t have a way of doing this. That’s why digital transformation has become such a hot topic in the financial services industry, with product managers and directors of digital transformation being hired in droves to bring about the much needed change. They need to be able to tap into the same fountain of knowledge that fintechs are. For every installation, every transaction, every outage, and every failure, there is a lesson to be learned. That’s why tapping into network effects is so essential for banks to keep up with client demand, lest they lose out to fintechs that can provide a better experience. Thus, becoming interoperable is of paramount importance.

Getting to Interoperable

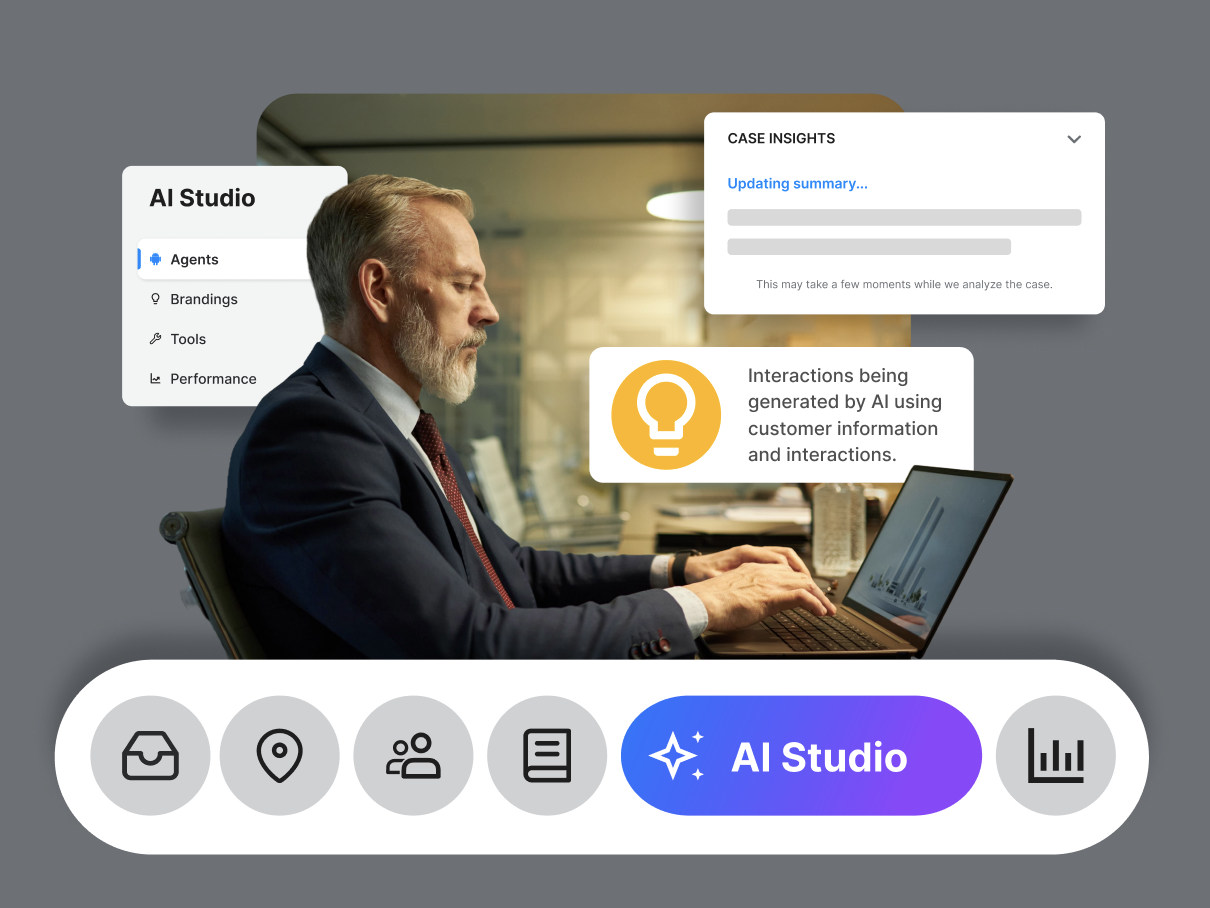

Banks need to forge a path forward toward better interoperability, that much is clear. They may seek to build solutions in house, creating miniature tech companies under their own umbrellas along the way. Others may not feel the urgency to innovate and will lose out. The smartest banks, however, will seek to understand and utilize platforms that can bring their existing infrastructure into the 21st century vis a vis an orchestration platform. After all, what’s the point of reinventing the wheel?

.svg)