Digital First is a Means to an End

Institutions that haven’t prioritized digital first are going to have trouble remaining competitive in the market. Convenience, usability, and – in the case of a pandemic – safety are now baseline expectations, as evidenced by increasing bank location closures.

But being digital-first isn’t the point. Yes, banks have been motivated to catch up with digital-first fintechs eating up market share. But now that digital first is the expectation, the “why” and “when” have evolved.

Years of digital data have given fintechs a unique advantage in truly putting themselves in the shoes of the customer and understanding the customer journey. They have, in essence, provided value to their customers by not only delivering services that place a premium on ease of use and accessibility, but have aggregated that data so that they know how to function at a higher capacity and efficiency than they already are. One of the key data points that they have become aware of is glaringly obvious — the ubiquity of internet accounts.

Fintechs take advantage of the fact that so many of their customers already use other products — for instance, most users already have Google accounts, Apple accounts, Financial accounts, or any and all of the above. They make signing up for their own services and products, vis-a-vis accounts that customers already have, a breeze. In doing so, fintechs have bested banks and established financial institutions by taking advantage of network effects.

Putting others’ work to use. . .

The easy sign-up example is obvious to anyone who’s downloaded an app in the past three years. It’s even more clear to anyone who’s connected their credit card to Apple’s Wallet functionality on an iPhone or AppleWatch. The ease of use provided by these systems is unparalleled. So, why is it that if credit card companies and payment processors have ensured that their products have kept up with the pace of technological advancement, that acquiring banks haven’t?

The answer is underinvestment in developing tech, which itself is a result of overinvestment in outdated tech. It wasn’t that long ago that many banks invested millions of dollars into transforming their technological capabilities, right around the time of the dotcom boom. Sadly, people couldn’t have foreseen the exponential scale at which technology advanced over the past 20+ years, and the ongoing, iterative process it would be.

In spite of the problems in front of them, banks treat most reforms with trepidation, for fear of a rip-and-replace approach knocking them out operationally, resulting in massive losses and client churn.The scar tissue that traditional banks and financial institutions have has led to a reticence to invest in even more technology, preventing them from being able to take advantage of network effects that would otherwise allow them to provide better customer experiences. They can’t envision a world in which they partner with fintech enablers at the customer-facing level, because they haven’t had the tools to do so previously. Fintech enablers, unlike fintech competitors, want to empower banks to evolve with the pace of technology, and catch up to the pace at which their processing partners have already developed. When technology products can’t function in tandem, they don’t function at all — which is why fintech competitors are increasing in market share, building products in-house that traditional banks do not. They’ve figured out how to work with payment processors at a level that banks haven’t.

Novo is a neobank that is looking to revolutionize the way that small businesses bank by taking advantage of network effects to make the entire experience digital first. In doing so, they have set up a framework for how traditional banks can offer services to their SMB clients. Instead of insisting on manual processes that require in-person set up, they provide easy set up through their mobile app. They are FDIC insured, integrate with myriad small business and processing tools, and offer exclusive perks that their digital-first advantage allows them to provide. Novo has, in effect, broken and re-cast the mold of what SMBs expect from banks for their business accounts.

. . . and building up from there

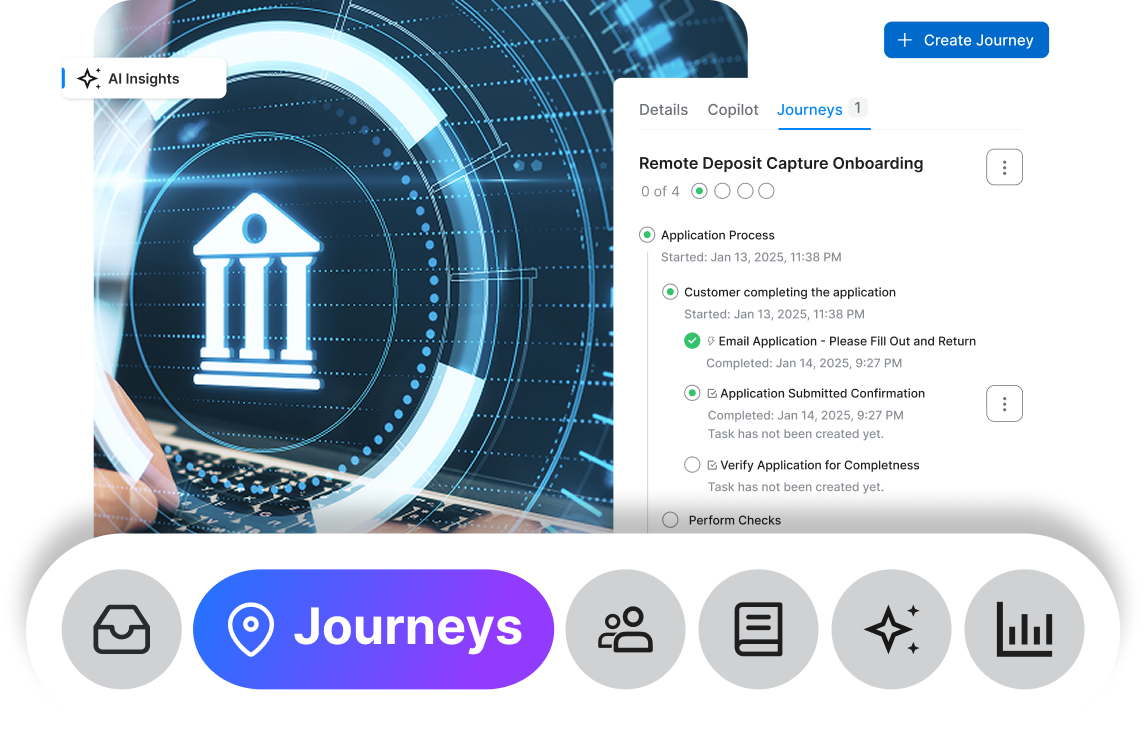

The good news is that, despite Novo’s success, financial institutions need not compete on becoming the “one stop shop” for financial ease of use - they still have massive competitive advantages. The modern financial institution is building out more diversified vendor ecosystems that span a customer’s entire journey, from education on through management of products and services. They’re increasingly doing this through system overlays and fintech enablers that integrate with their partners’ workflows, processes, and products, providing them with a unified view of the customer, and allowing them to finally take advantage of network effects.

The imperative for today’s banks is to start reaping the benefits of network effects by integrating deeply with fintech enablers. They must gain and maintain complete visibility and control across their vendor ecosystems, so they can seamlessly orchestrate the customer journey. In doing so, they’ll gather insights about their customers they would otherwise miss — and can iterate and adapt from there.

.svg)