Pizza tracker: A Blueprint for Customer Journey Orchestration For Banks

Domino’s Pizza transformed the customer experience game with its real-time Pizza Tracker, which let customers follow their order from kitchen to doorstep. It didn’t just satisfy curiosity—it reduced anxiety, boosted confidence and gave customers the sense of control they craved. The results? A significant increase in online orders and brand loyalty. Domino’s credited it with helping drive a 40% year-on-year increase in sales in some regions.

Fast-forward to today: many industries have adopted similar transparency, giving users visibility into the process and control over interactions. But financial services has been slower to incorporate this type of CX visibility.

However, the more complex the product or service, the more critical this kind of journey visibility is to set expectations and alleviate concerns.

Marketing Journeys vs. Customer Lifecycle Journeys

When we talk about customer journey visibility, it's not only about marketing journeys designed to attract, nurture and convert prospects. At OvationCXM we focus on the customer lifecycle journeys that happen after the customer has said "yes" and is trying to get up and running using the product. It includes onboarding, product adoption, support interactions, renewals and hopefully, cross sales. This is where the long-term value is realized—or lost.

Marketing automation tools keep track of customers, but customer journey orchestration tools coordinate real-time experiences across systems, teams and third parties to ensure it's consistently smooth. Optimizing individual touch points in a workflow has been a focus up until now vs. managing the entire lifecycle, but as competition and customer expectations intensify, financial institutions must pay attention to every interaction in the end-to-end journey.

Why Customer Journey Orchestration Matters

Customer journey orchestration is actively managing and designing the customer lifecycle: knowing what comes next, who’s involved, and how to proactively remove friction before it damages the relationship.

When done right, journey orchestration provides:

- Real-time visibility into every step of a process

- Clear expectations around timelines, responsibilities and next steps

- Cross-functional coordination, even across third-party ecosystem partners like payment processors, software vendors or core banking providers

- Proactive adjustments and actions that prevent escalations and abandonment

Most banks still operate with a patchwork of disconnected systems that are highly reliable but not integrated with one another. Core platforms, CRMs, case management tools and third-party vendors don’t share information easily—leaving customers stuck in the middle, repeating their story at every touchpoint.

Why Financial Services Struggle with Orchestration

The problem isn’t only this disparate technology per se —it’s the culture of fragmentation. Banks have done an excellent job of optimizing for efficiency in each department, without reevaluating those impacts on the whole journey.

Common obstacles include:

- Legacy systems that aren’t built for real-time data sharing or agility

- Siloed teams and platforms that prevent a 360° view of the customer journey

- Rigid workflows that assume linear progress when real journeys are fluid and multi-party

- Compliance and security concerns that discourage integration

- External partners and fintechs that hold the bank's first-party customer data in their third-party systems

This fragmentation leads to inconsistent handoffs, repeated information requests, long wait times and lost opportunities to engage or upsell.

Transparency Is the Missing Link

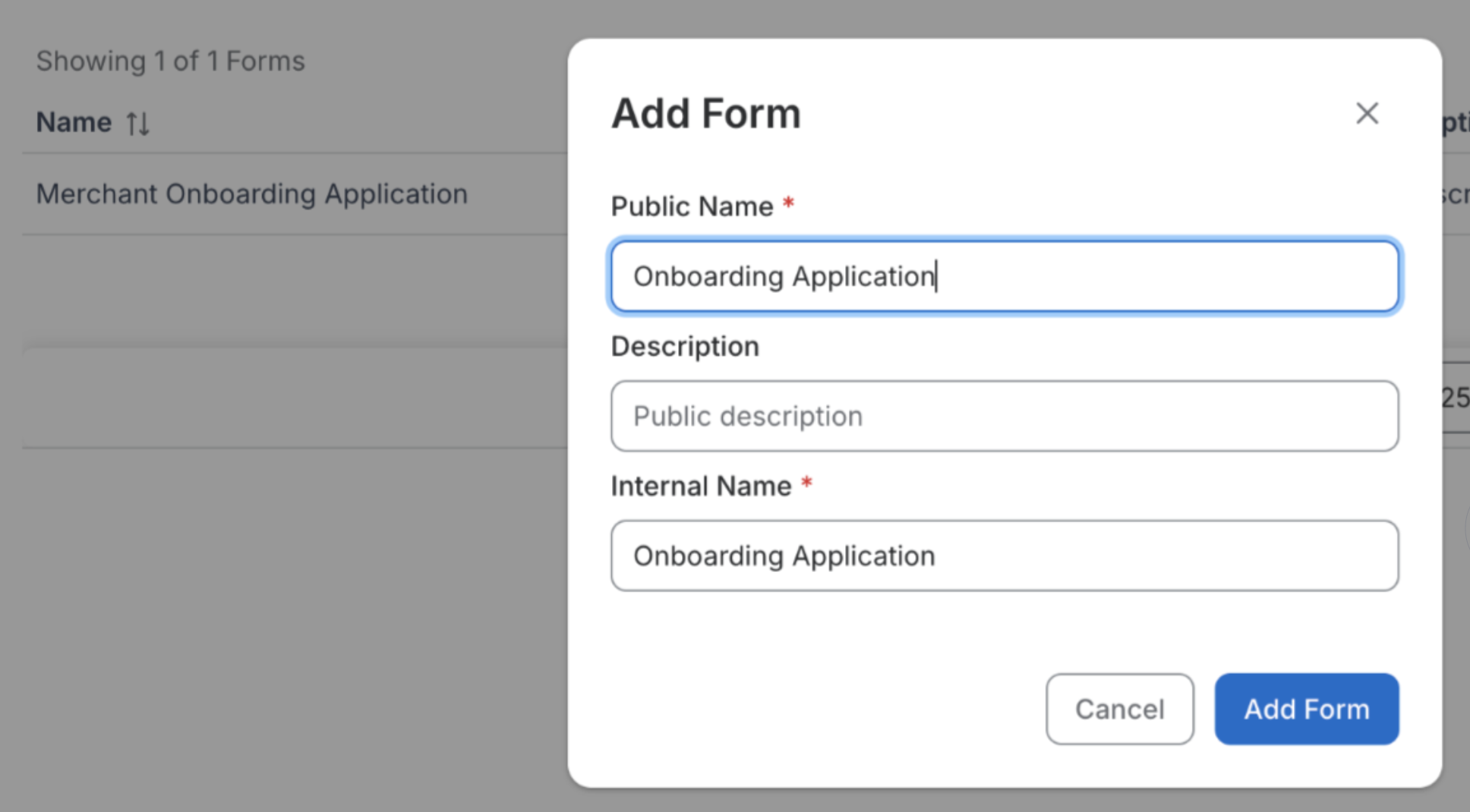

Just 28% of businesses OvationCXM surveyed described their onboarding as transparent, and the #1 frustration cited was “confusing or unclear processes.”

That’s not a small oversight—it’s a customer experience failure with major consequences. In fact, 25% of businesses abandoned onboarding entirely, with complex products like treasury management and merchant services seeing the highest fallout.

Transparency—knowing where you are in the process, what’s coming next, and who’s responsible—builds trust. It lowers anxiety. It reduces support calls. And it keeps customers engaged.

Think back to the Domino’s Pizza Tracker. It's not just clever UX—it’s a blueprint for orchestration. Banks need their own tracker for onboarding and support journeys as well.

With journey orchestration, financial institutions can show customers:

- What’s happening now

- What’s next

- Who owns it

- When it’s expected

- Information that's needed or missing to progress the journey

This journey visibility is the fastest way to reduce friction and improve satisfaction.

"Banks will need to move beyond highly standardized products to create integrated propositions that target “jobs to be done.”⁸ This requires embedding personalization decisions (what to offer, when to offer, which channel to offer) in the core customer journeys and designing value propositions that go beyond the core banking product and include intelligence that automates decisions and activities on behalf of the customer. - McKinsey

What do businesses think of their banking customer experience? Download the full research report.

Business Impact of Poor CX Orchestration

In OvationCXM’s 2025 Business Banking CX Survey:

- 56% of businesses said they had to interact with 2–3 departments to resolve a single issue

- 91% said they were asked to repeat information multiple times

- 41% expected resolution within 24 hours, while 82% said they would leave if an issue wasn’t resolved within 3 days

Without journey orchestration, banks risk losing not just satisfaction—but business.

What Banks Should Do Next

To meet modern expectations and remain competitive, financial institutions must:

• Implement customer journey orchestration platforms that unify data and journey steps across teams and third-party partners

• Expose real-time journey status, from end to end so customers can see exactly what's happening

• Design journeys from the customer’s POV, not internal departments

• Use AI and automation to flag bottlenecks, personalize outreach, and resolve issues faster

The old model of servicing customers with tickets and siloed handoffs isn’t sustainable. Banks need to think bigger than CRM and smarter than automation. Journey orchestration is the foundation empowering banks to deliver seamless, satisfying, customer-centric experiences.

.svg)